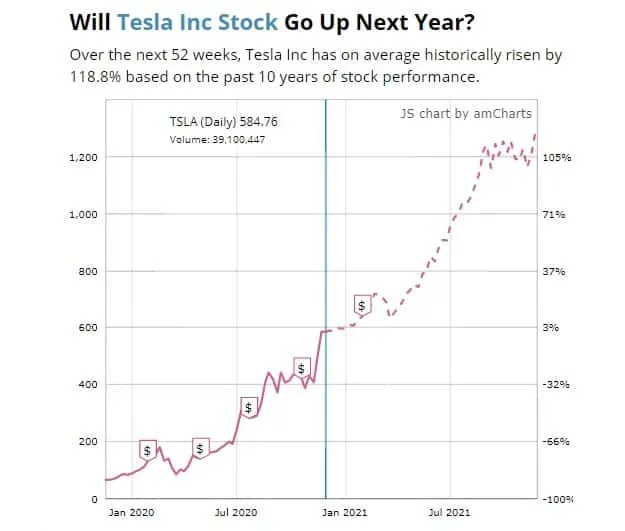

When examining the latest Tesla stock recommendation, recent insights from JPMorgan suggest that investors should consider selling their shares. This stark advisory has sparked considerable debate among industry analysts, including CNBC’s Phil LeBeau, who discussed the implications of this call on the show ‘Money Movers.’ Investors seeking a comprehensive Tesla stock analysis can delve into the factors that led to JPM’s decision and how it aligns with broader market trends. Additionally, while some might be drawn to other high-profile stocks, it’s essential to stay informed about Tesla’s fluctuating performance and related news. This backdrop sets the stage for understanding not only the challenges facing Tesla but also the potential pitfalls of holding onto this stock amid changing market conditions.

In light of recent events, the conversation around Tesla’s financial outlook has intensified, particularly with the recent advisory from JPMorgan to rethink stock positions. As analysts dissect the viability of investing in this electric vehicle giant, questions arise regarding Tesla’s future market performance. Phil LeBeau’s insights on ‘Money Movers’ shine a light on the dynamics influencing Tesla and highlight potential alternatives for those wary of current risks. Furthermore, as discussions about ‘sell’ recommendations circulate, it’s crucial to analyze the sentiment and trends surrounding the company. The implications of such advice can ripple through the entire stock market, urging investors to remain vigilant.

JPM’s Tesla Stock Recommendation Analysis

In a recent move, JPMorgan Chase issued a sell recommendation on Tesla stock, raising eyebrows among investors and analysts alike. This call has significant implications for those involved in Tesla’s dynamic market. As one of the leading financial institutions, JPM’s stance is often seen as a bellwether for broader market sentiments. Investors are now left pondering whether this warning signals a larger trend of underperformance for Tesla in the near future.

JPM’s analysis points to various factors influencing their decision, including Tesla’s fluctuating production costs and competition within the electric vehicle market. The firm suggests that while Tesla has been a leader in innovation, its current valuation may not align with its operational realities. This assessment aligns with other recent Tesla stock analysis discussions highlighting potential hurdles that could affect the company’s stock performance.

Frequently Asked Questions

What is the latest JPM Tesla sell recommendation and its impact on the stock?

JPM’s latest recommendation suggests selling Tesla stock, attributing this call to concerns over valuation and market factors. Investors should consider this analysis when evaluating their positions in Tesla stock.

How does Phil LeBeau’s analysis influence Tesla stock recommendations?

Phil LeBeau’s insights often provide valuable context for Tesla stock recommendations. His expert analysis on ‘Money Movers’ can help investors understand market trends and the implications of news affecting Tesla.

What factors are influencing the recent Tesla stock analysis by market experts?

Recent Tesla stock analysis has been heavily influenced by stock performance, market demand, and competitive pressures. Analysts, including those from JPM, weigh these factors to formulate their recommendations.

Why might investors consider JPM’s Tesla stock recommendation to sell?

Investors may consider JPM’s Tesla stock recommendation to sell due to concerns over high valuations and potential market corrections. Following expert guidance can help mitigate risks in investment portfolios.

How did Boeing’s May orders affect Tesla stock recommendations?

While Boeing’s May orders are not directly related to Tesla, fluctuations in the aerospace market can influence investor sentiment across sectors, including Tesla. Market dynamics can lead analysts like JPM to reassess their Tesla stock recommendations.

What insights does CNBC’s Phil LeBeau provide on Tesla stock trends?

CNBC’s Phil LeBeau offers insights into Tesla stock trends through in-depth analysis and commentary. His discussions often cover factors such as sales performance and market conditions that can affect stock recommendations.

Are there alternative views on the Tesla stock recommendation besides JPM’s sell suggestion?

Yes, alternative analyses may support holding or even buying Tesla stock based on long-term growth potential. Investors should consider various perspectives to make informed decisions.

How can I stay updated on Tesla stock recommendations and market changes?

To stay updated on Tesla stock recommendations and market changes, investors should follow reputable financial news outlets, subscribe to analyst reports, and consider expert commentary from figures like Phil LeBeau.

| Key Point | Details |

|---|---|

| JPM’s Recommendation | JPMorgan recommends selling Tesla stock. |

| Reason for Recommendation | Concerns about Tesla’s future performance contributed to the downgrade. |

| Media Coverage | Phil LeBeau from CNBC discusses the implications of this recommendation on ‘Money Movers’. |

| Related Topic | Discussion also includes Boeing’s May orders. |

Summary

The Tesla stock recommendation from JPMorgan urges investors to sell their shares. This is based on concerns regarding the company’s future performance amidst new market dynamics. Investors should consider this guidance seriously, as it reflects the analysis of significant financial institutions. Following the advice of experts can help in making informed investment decisions regarding Tesla’s stock.